Do you know how much wealth American women control?

Don’t overlook making a plan to support this growing group of financial decision makers. Use this infographic to get started.

Join us to become a better resource for your clientele! Login / Register | Telephone: 601.487.2774

Logout | Telephone: 601.487.2774

Learn

Do you know how much wealth American women control?

Don’t overlook making a plan to support this growing group of financial decision makers. Use this infographic to get started.

“Opportunities for permanent life insurance sales have grown

exponentially as the landscape has shifted. Opportunities have risen and financial

advisors who capitalize first may see the greatest advantage in building their

practice.”https://files.constantcontact.com/f60f9af2201/7f463371-d50d-4934-bbaa-a80186aed7a9.pdf

2020 Fingertip Tax Guide – Including annual adjustments affecting income tax rates, transfer tax exemptions, qualified plan contribution amounts and more! Be sure to save a copy of this handy guide for quick reference.

https://go.johnhancockinsurance.com/c0s00a7P0xFB0w3Z20XiU00

Almost 1 in 2 American households have a life insurance protection gap of $200,000 each – for a total market need of $12 trillion. Get strategies for the top 3 opportunities in the underinsured market.

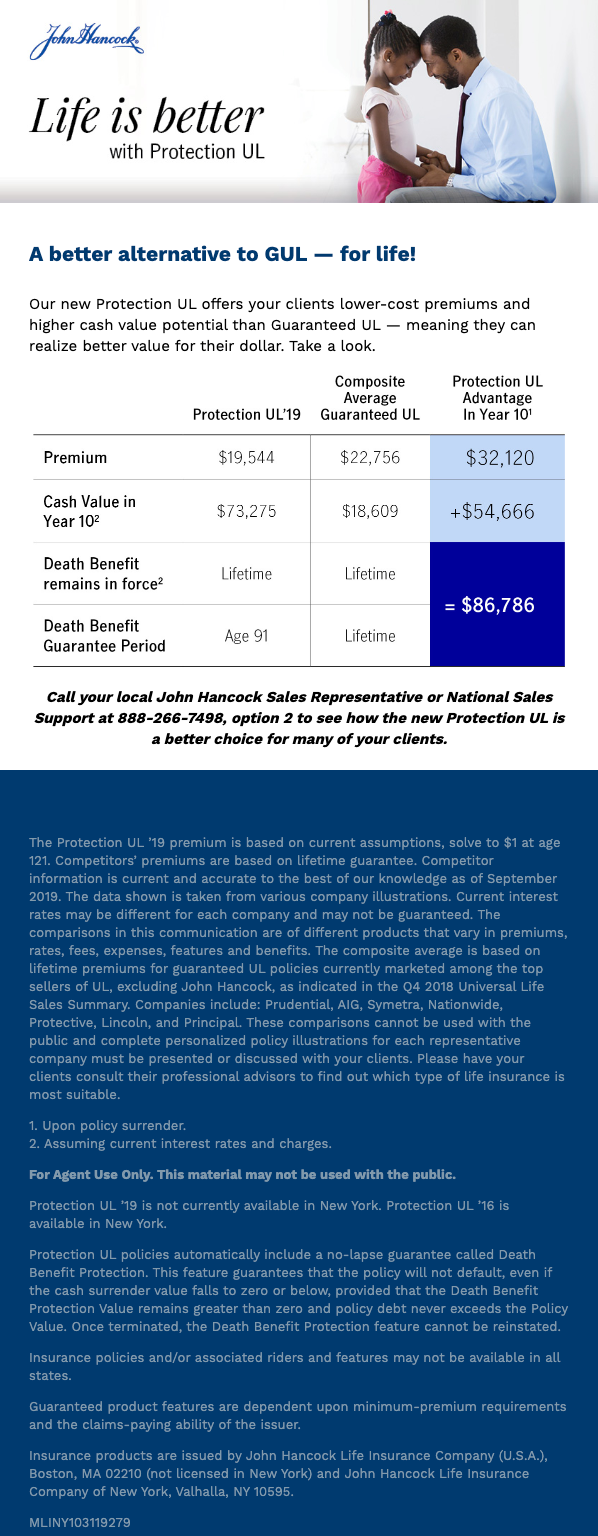

Lower-cost premiums and higher cash value potential. Take a look!