…And Blissfully Guaranteed

The vagaries of the market….. We know that some investments rise as others fall; and that returns ebb and flow. Diversification of asset classes prevent over-exposure of certain assets in a financial melt-down. For example- Bonds may be spared in a stock market collapse while real estate, or even cash, may be investment “safe havens.” Only one asset class is perfectly non-correlated to everything- completely independent of all financial influences………

Perfect non-correlation means independence from outside financial influence. Virtually all investments respond to financial conditions in a yin-yang fashion. Gold prices fluctuate with currency and interest rate changes. The value of Bonds go down as interest rates rise; and rise as interest rates fall. Equity indices seem to respond (or maybe react) to everything.

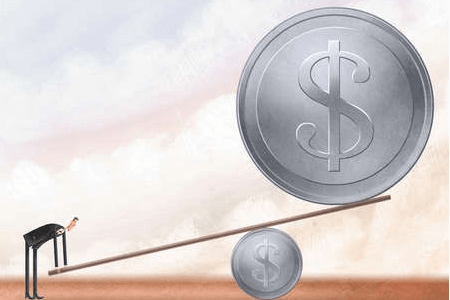

The only perfectly non-correlated asset class is life insurance. Examining the Internal Rate of Return (IRR) at Death– that is, the rate of return you would have to realize on the premiums paid in order to equal the benefit paid at death– can make a compelling case to have life insurance in every well-diversified portfolio. Modern life insurance pricing is producing very attractive IRR’s at Death to life expectancy and even later—–with positive returns even past age 100.

Case Study

John is a 60-year-old career professional with a well-diversified investment portfolio consisting of Stocks, Bonds, Cash, Real Estate and International Stock & Bond funds. A substantial portion of his portfolio should be unneeded for retirement and will go to heirs, and to charitable bequests, at his death.

Here are certain aspects to consider for making an argument for John to purchase a life insurance policy, on his own life, as part of his portfolio:

| John’s life expectancy: | Age 85 (25 years) |

| $1,000,000 policy on John’s life: | $14,500 annual premium* |

| Death proceeds payable: | $1,000,000 (income tax free) |

| Total premiums paid ot life expectancy: | $362,625 |

| IRR at Death at Age 85: | 7.12% |

| IRR at death at age 95 (LE + 10 years): | 3.49% |

| Enhanced Cash Surrender Value at age 85: | $362,626 |

*Premium and death benefit are guaranteed to age 105.

A carefully selected life insurance policy can deliver impressive returns whenever death occurs, and the returns are perfectly non-correlated to outside financial influences.

Only One Asset Class is Blissfully Unaffected by the Markets ……

….and Blissfully Guaranteed

For agent educational purposes only. Not for use with the public.