It’s estimated that 70% of people over age 65 will need Care at some point of their life; but….. some people choose not to obtain coverage to protect against this financial risk. Why? Well, some people feel certain that they’ll be in the 30% who won’t need Care; others simply think they have enough assets to “Self-Insure”.

Now, new combination plans can take a small portion of liquid assets and, via leverage, provide for efficient risk management to pay for Care while providing a 100% Return of Premium guarantee from day one……….

Case Study

- Bill is a 68-year-old business owner who is considering selling his business and retiring. The business has provided Bill very good cash flow thru the years which, with the help of his Financial Advisor (FA), has allowed him to accumulate substantial assets including Stocks, Bonds, Cash and Real Estate holdings.

- Bill’s mother is 89 years old and was diagnosed with Alzheimer’s Disease a few years back; she’s now in a Nursing Home. Bill writes the checks each month to pay for her Care so he can quickly tell you that the cost of a private room in a nursing home in Mississippi is over $7,000 per month.

- He’s heard that 70% of people over age 65 will need some form of Care during their lifetime but he’s not concerned; he knows that he’ll be in the 30% who won’t need it. He also feels he has enough assets to self-insure (should the unlikely occur). So, there’s no reason to waste money on something he doesn’t need.

- Bill and his FA recently sat down to discuss his possible retirement.

- They agree that his portfolio should provide the income he needs to live very comfortably in retirement.

- His FA agrees that if anyone can beat the 70% odds of needing Care, it will probably be Bill

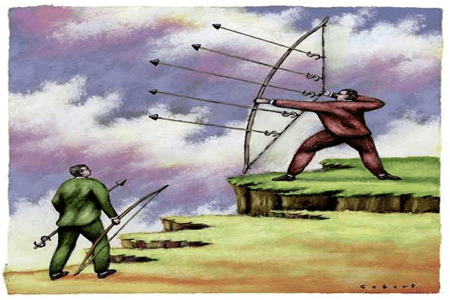

- But, he points out to Bill that if he needs Care, as unlikely as it may be, he’ll be paying for it with 100 pennies on a dollar (after tax pennies) and, even a well-diversified portfolio such as Bill’s can take significant hits from time to time (as Bill’s portfolio did during, and a few years following, the late unpleasantness of 2008 and 2009), So, if he needs Care during a period like that, he’ll be paying for it with very expensive dollars.

So he poses a question to Bill, “If a Long-Term Care Insurance plan provided you a 100% Return of Premium guarantee (thus the “cost” would be the loss of earnings on the premium paid), while providing income-tax free leverage of $3 or $4 to $1 to pay for Care, would that be worth considering?”.

He gives Bill an example what a policy, paid via $150,000 taken from his cash reserves, would provide:

- An initial $474,615 pool of funds to pay for Care for up to seven years (leverage of $3.16 to $1) and grow, via a 5% Simple Interest Inflation Benefit, to $722,241 by age 80 (leverage of $4.81 to $1), or

- $150,000 of surrender value, from day one (less any benefits paid for Care), or

- $150,000 death benefit (less any benefits paid for Care or Cash taken from the policy).

If you were Bill, what would you do?

“Portfolio Insurance” ……. for Efficient Risk Management.

For producer education only; not for use with the public.

PL01152019